python量化策略——Fama-French三因子模型(回归获取alpha)阿尔法α策略。

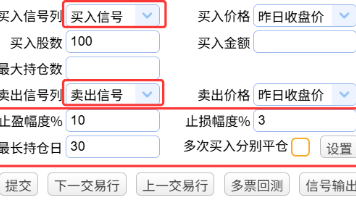

简单的alpha策略,选取某一时间点所有股票的相关信息ps、pb、pe等。用三因子回归获取alpha,分别用每只股票计算。选取排名靠前的n只股票计算组合净值计算结果和画图注:代码运行需安装tushar pro 并获取TOKEN码,这里获取token码# coding=utf-8import mathimport tushare as tsimport pandas as pdimport matp

·

简单的alpha策略,

- 选取某一时间点所有股票的相关信息ps、pb、pe等。

- 用三因子回归获取alpha,分别用每只股票计算。

- 选取排名靠前的n只股票

- 计算组合净值

- 计算结果和画图

注:代码运行需安装tushar pro 并获取TOKEN码, 这里获取token码

# coding=utf-8

import math

import tushare as ts

import pandas as pd

import matplotlib

import matplotlib.pyplot as plt

import numpy as np

import talib

import pandas as pd

from datetime import datetime, date

from sklearn import datasets

from sklearn.model_selection import train_test_split

import matplotlib.pyplot as plt

from sklearn.linear_model import LinearRegression

matplotlib.rcParams['axes.unicode_minus']=False

plt.rcParams['font.sans-serif']=['SimHei']

ts.set_token('”输入token码“')

pro = ts.pro_api()

############################读取数据类###################################

class readData:

def read_index_daily(self,code,star,end):#指数数据

dsb = pro.index_daily(ts_code=code, start_date=star, end_date=end,fields='ts_code,trade_date,close,change')#默认读取三个数据

return dsb

def read_daily(self,code,star,end):

dsc1 = pro.daily(ts_code=code, start_date=star, end_date=end,fields='ts_code,trade_date,close')

return dsc1

def read_CPI(self,star,end):#时间格式start_cpi='201609'

dc=pro.cn_cpi(start_m=star, end_m=end,fields='month,nt_yoy')

return dc

def read_GDP(self,star,end):#时间格式star='2016Q4'

df1 = pro.cn_gdp(start_q=star, end_q=end,fields='quarter,gdp_yoy')

return df1

def read_bond(self,code,star,end):

df=pro.cb_daily(ts_code=code,start_date=star,end_date=end)

def read_base(self,code):

df=pro.query('daily_basic', ts_code=code,fields='close,ts_code,pb,total_mv,trade_date')

return df

#######################################################################################

start_time='20180226'#发布GDP需要时间,我们延迟1个月,即第一季度的GDP4月份才发布。

end_time="20180521"

dc=readData()

dsc1=readData()

dsb1=readData()

###################计算alpha的值###########################################################

def alpha_fun(code):

dsb=dsb1.read_base(code) .fillna(0)

dsc=dsc1.read_index_daily('000300.SH',start_time,end_time)

dsc.set_index(['trade_date'],inplace=True)

dsb.set_index(['trade_date'],inplace=True)

df=pd.merge(dsc, dsb, on='trade_date').fillna(0)

R=np.reshape( np.array([df.close_y]) , (-1,1) )

R_f=np.reshape( np.array([ (df.change/(df.close_x.shift(-1))).fillna(0) ]) , (-1,1) )#用0 填充nan

HMI=np.reshape( np.array([ (1/df.pb).fillna(0) ]) , (-1,1) )

SMB=np.reshape( np.array([ df.total_mv]) , (-1,1) )

X=np.concatenate(( R_f-4/252, HMI,SMB ),axis=1)

y1=np.reshape(R,(1,-1)).T

X_train, X_test, y_train, y_test = train_test_split(X, y1, test_size=0.3, random_state=0)

linear = LinearRegression()

linear.fit(X_train, y_train)

alpha=linear.intercept_-4/252

return alpha,linear.intercept_ ,linear.coef_,linear.score(X_test, y_test),df

############################计算篮子里的每只股票净值###############################################

def jinzhi_fun(code,start_time,end_time):#计算净值

df=pro.query('daily', ts_code=str(code), start_date=start_time, end_date=end_time,fields='')

df.index=pd.to_datetime(df.trade_date,format="%Y-%m-%d")

jinzhi=(df.close/df.close[-1])

return jinzhi

######################选股条件####################################################

co=pro.query('daily_basic', ts_code="",trade_date="20180226",fields='ts_code')

code_list=[]

N=30#股票池

k=0

JZ=0#组合净值

cum=0

for i in co.ts_code.values[0:N]:

try:

if alpha_fun(i)[0]<0:

k+=1

JZ=jinzhi_fun( str(i) ,start_time,end_time) +JZ

JZ=JZ.fillna( method='bfill')#用前后数据特征填充

except ValueError:

pass

continue

#########################计算权重收益净值#########################################

JZ=JZ.sort_index(axis=0,ascending=True)

JZ_avg=JZ/k#平均净值

cum=np.cumprod(JZ_avg)# 累计收益

####################计算收益率函数,如沪深300#####################################

def JZ_function(code,star,end):

df12 = pro.index_daily( ts_code=code, start_date=star, end_date=end)

df12=df12.sort_index( )

df12.index=pd.to_datetime(df12.trade_date,format='%Y-%m-%d')#设置日期索引

ret12=df12.close/df12.close[-1]

return ret12.dropna()

#############################策略的年化统计######################################

def Tongji(jz):

NH=(jz.dropna()[-1]-1)*100*252/len(jz.index)

BD=np.std(jz)*100*np.sqrt(252)

SR=(NH-400/252)/BD

return_list=jz.dropna()

MHC=((np.maximum.accumulate(return_list) - return_list) / np.maximum.accumulate(return_list)).max()*100

print("年化收益率:{:.2f}%:,年化夏普率:{:.2f},波动率为:{:.2f}%,最大回撤:{:.2f}%".format( NH,SR,BD,MHC))

############################################################################

if __name__=="__main__":

cum12=JZ_function('000300.SH',start_time,end_time)

Tongji(JZ_avg)

plt.plot(cum12,label="沪深300",color='b')

plt.plot(JZ_avg,label="股票组合",color='r')

plt.title("alpha股+指期对冲策略")

plt.legend()

结果:

年化收益率:44.75%:,夏普率:0.84,波动率为:51.64%,最大回撤:7.77%

1.python量化——alpha股票-指数期货对冲策略

2.多因子选股策略

3.海龟交易策略

4.移动平均策略——单/双均线策略

5.改进的美林时钟(介绍)

6.改进的美林时钟策略(一)

7.改进的美林时钟策略(二)

8.改进的美林时钟策略(三)

这里获取token码

更多推荐

已为社区贡献1条内容

已为社区贡献1条内容

所有评论(0)