ptrade量化策略之沪深300指数增强

本策略的核心是在沪深300股票池中选股,选择的股票都是市值比较大,业绩比较好的白马股,根据市场相对位置以及基本面因子来选择股票

·

本策略的核心是在沪深300股票池中选股,选择的股票都是市值比较大,业绩比较好的白马股,根据市场相对位置以及基本面因子来选择股票,每月调仓一次,总的手续费低,策略的容量比较大,比较适合资金量大的稳健投资者和上班族。

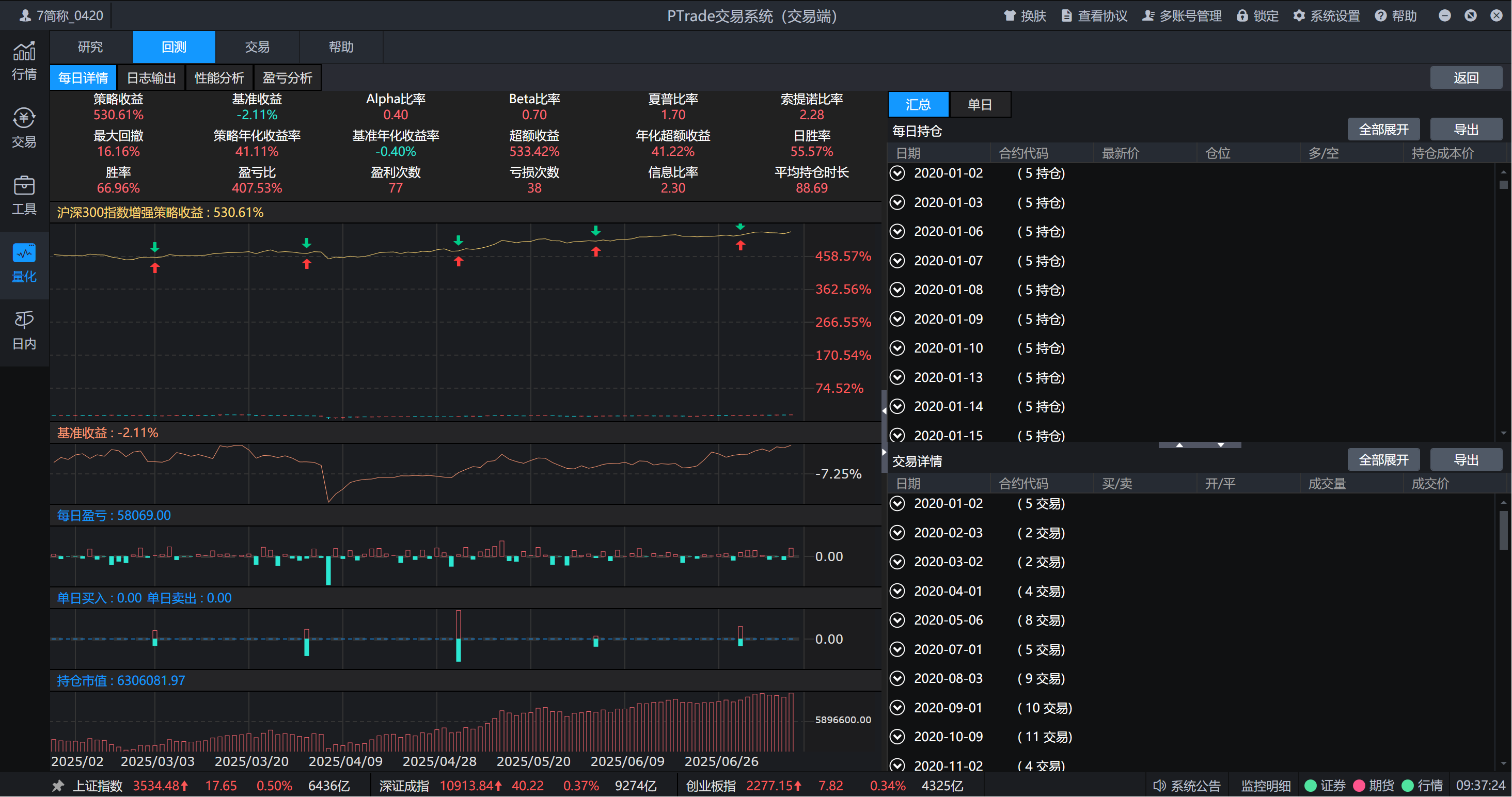

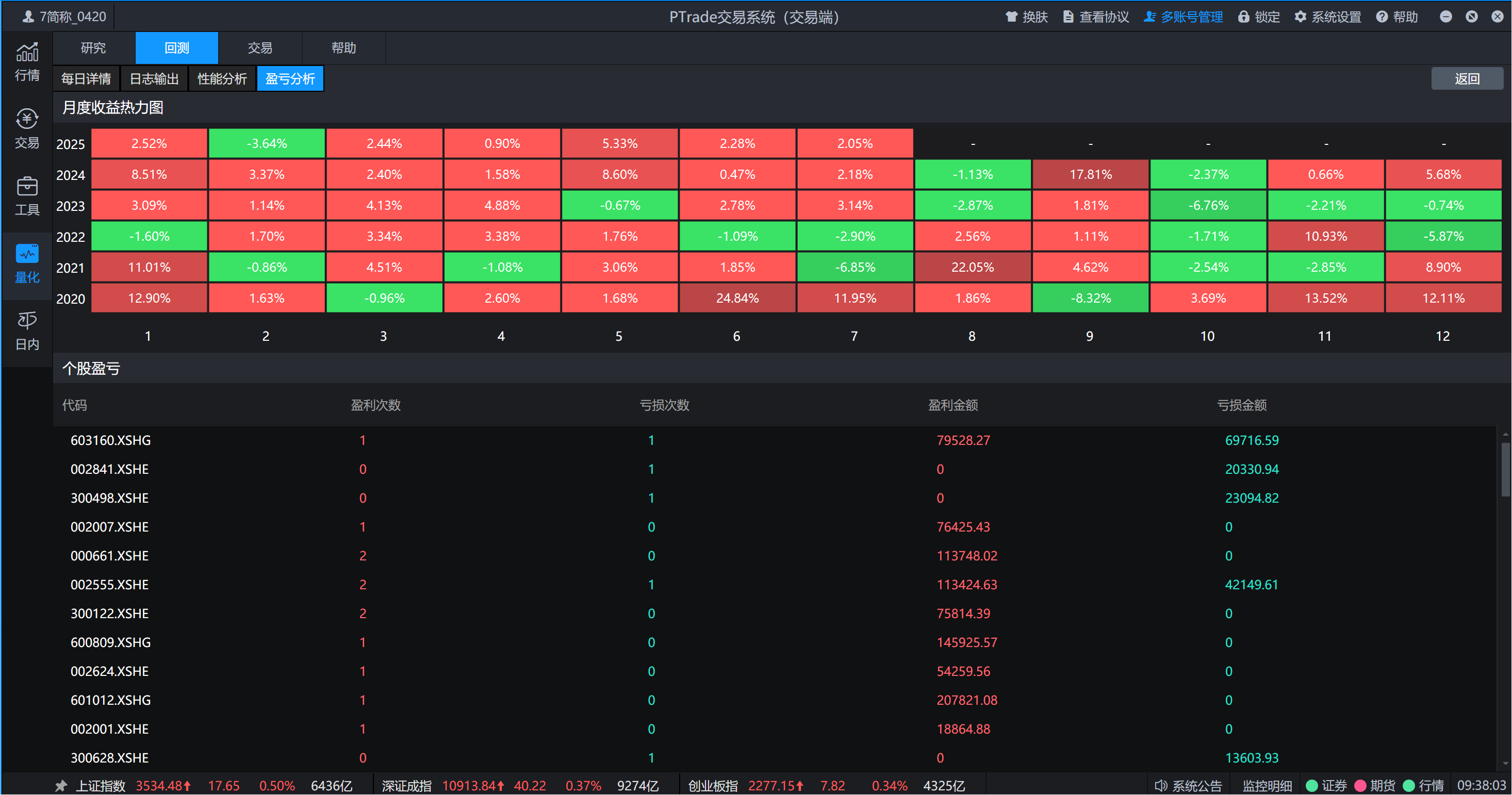

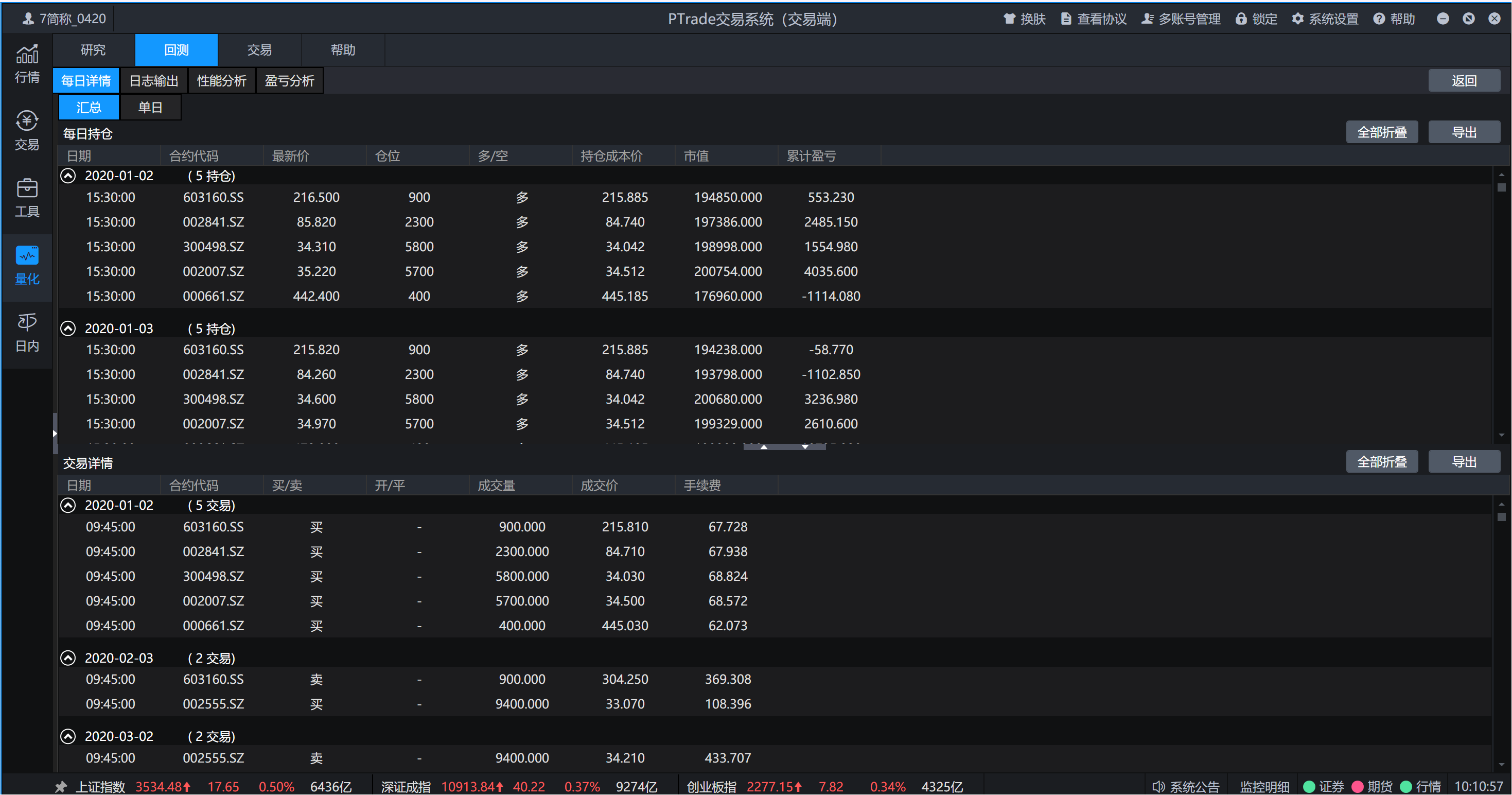

回测数据(2020.1.1-2025.7.10)如下:

*回测数据只作测试用,不代表未来实际收益

1、策略初始化配置

定义了持股数、股票池、市场位置、调仓函数等

g.buy_stock_count = 5 # 持股数

g.check_out_lists = [] # 股票池

g.market_temperature = "mid" # 市场位置

g.month = 0 # 记录月份

# 调仓函数

run_daily(context, my_trade, time='9:45')2、盘前处理

(1)计算市场位置

市场位置监控,获取沪深300指数过去220个交易日的收盘价,计算市场的相对位置,如果在0.2以下就是底部区域,0.9以上就是顶部区域,最近60日最高涨幅超过20%就是相对温和上涨位置。

def Market_temperature(context):

index300 = get_history(220, frequency="1d", field="close", security_list="000300.SS").close.tolist()

market_height = (np.mean(index300[-5:]) - np.min(index300)) / (np.max(index300) - np.min(index300))

if market_height < 0.20:

g.market_temperature = "low"

elif market_height > 0.90:

g.market_temperature = "high"

elif np.max(index300[-60:]) / np.min(index300) > 1.20:

g.market_temperature = "mid" (2)过滤科创北交、ST、停牌、当日涨停股票

all_stocks = get_index_stocks("000300.SS")

list = []

check_out_lists = []

final_list = filter_st_status(all_stocks)

final_list = filter_halt_status(final_list)

final_list = filter_deli_status(final_list)

for stock in final_list:

info = get_stock_info(stock)

if not (('ST' in info[stock]["stock_name"]) or

('*' in info[stock]["stock_name"]) or

('退' in info[stock]["stock_name"]) or

(stock.startswith('30')) or # 创业

(stock.startswith('68')) or # 科创

(stock.startswith('8')) or # 北交

(stock.startswith('4'))):

list.append(stock)(3)根据市场位置选股

低位:选择强现金流、扣非净利润为正的破净股,以roa/pb来排序

中位:选择营收翻倍高增的破净股,以roa/pb来排序

高位:选择pb3以上当前营收3倍高增、利润20%增长的成长股, 只用roa排序

选出6只股票

if g.market_temperature == "low":

check_out_lists = get_market_low(context, list)

elif g.market_temperature == "mid":

check_out_lists = get_market_mid(context, list)

elif g.market_temperature == "high":

check_out_lists = get_market_high(context, list)def get_market_low(context, stock_list):

df = get_fundamentals(stock_list, "valuation", fields=["pb"],

date=context.previous_date)

df = df[(df["pb"] > 0) & (df["pb"] < 1)]

if df.empty:

return []

list = df.index.tolist()

# print(list)

subtotal_operate_cash_inflow_df = get_single_fundamentals(context, list, "cashflow_statement", "subtotal_operate_cash_inflow")

net_profit_cut_df = get_single_fundamentals(context, list, "profit_ability", "net_profit_cut")

net_profit_grow_rate_df = get_single_growth_fundamentals(context, list, "income_statement", "net_profit")

roe_cut_df = get_single_roe_cut_fundamentals(context, list)

roa_df = get_single_roa_fundamentals(context, list)

df = pd.concat([subtotal_operate_cash_inflow_df, net_profit_cut_df, net_profit_grow_rate_df, roe_cut_df, roa_df], axis=1)

df["division"] = df["subtotal_operate_cash_inflow"] / df["net_profit_cut"]

df = df[(df["subtotal_operate_cash_inflow"] > 0) & (df["net_profit_cut"] > 0) & (df["net_profit"] > -15) & (df["division"] > 2) & (df["roe_cut"] > 1.5)]

if df.empty:

return []

filter_list = df["stocks"].iloc[:, -1].tolist()

pb_df = get_fundamentals(filter_list, "valuation", fields=["pb"],

date=context.previous_date)

stocks_pb = pb_df["pb"].tolist()

df["pb"] = stocks_pb

df["sort"] = df["roa"] / df["pb"]

df = df.sort_values(by="sort", ascending=False)

filter_list = df["stocks"].iloc[:, -1].tolist()

print(filter_list)

return filter_list[:6]def get_market_mid(context, stock_list):

# stock_list = ["601211.SS", "600036.SS"]

df = get_fundamentals(stock_list, "valuation", fields=["pb"],

date=context.previous_date)

df = df[(df["pb"] > 0) & (df["pb"] < 1)]

if df.empty:

return []

list = df.index.tolist()

subtotal_operate_cash_inflow_df = get_single_fundamentals(context, list, "cashflow_statement", "subtotal_operate_cash_inflow")

net_profit_cut_df = get_single_fundamentals(context, list, "profit_ability", "net_profit_cut")

net_profit_grow_rate_df = get_single_growth_fundamentals(context, list, "income_statement", "net_profit")

roe_cut_df = get_single_roe_cut_fundamentals(context, list)

roa_df = get_single_roa_fundamentals(context, list)

df = pd.concat([subtotal_operate_cash_inflow_df, net_profit_cut_df, net_profit_grow_rate_df, roe_cut_df, roa_df], axis=1)

df["division"] = df["subtotal_operate_cash_inflow"] / df["net_profit_cut"]

df = df[(df["subtotal_operate_cash_inflow"] > 0) & (df["net_profit_cut"] > 0) & (df["net_profit"] > 0) & (df["division"] > 1) & (df["roe_cut"] > 2)]

if df.empty:

return []

filter_list = df["stocks"].iloc[:, -1].tolist()

pb_df = get_fundamentals(filter_list, "valuation", fields=["pb"],

date=context.previous_date)

stocks_pb = pb_df["pb"].tolist()

df["pb"] = stocks_pb

df["sort"] = df["roa"] / df["pb"]

df = df.sort_values(by="sort", ascending=False)

filter_list = df["stocks"].iloc[:, -1].tolist()

print(filter_list)

return filter_list[:6] def get_market_high(context, stock_list):

df = get_fundamentals(stock_list, "valuation", fields=["pb"],

date=context.previous_date)

df = df[df["pb"] > 3]

if df.empty:

return []

list = df.index.tolist()

subtotal_operate_cash_inflow_df = get_single_fundamentals(context, list, "cashflow_statement", "subtotal_operate_cash_inflow")

net_profit_cut_df = get_single_fundamentals(context, list, "profit_ability", "net_profit_cut")

net_profit_grow_rate_df = get_single_growth_fundamentals(context, list, "income_statement", "net_profit")

roe_cut_df = get_single_roe_cut_fundamentals(context, list)

roa_df = get_single_roa_fundamentals(context, list)

df = pd.concat([subtotal_operate_cash_inflow_df, net_profit_cut_df, net_profit_grow_rate_df, roe_cut_df, roa_df], axis=1)

df["division"] = df["subtotal_operate_cash_inflow"] / df["net_profit_cut"]

df = df[(df["subtotal_operate_cash_inflow"] > 0) & (df["net_profit_cut"] > 0) & (df["net_profit"] > 20) & (df["division"] > 0.5) & (df["roe_cut"] > 3)]

if df.empty:

return []

df = df.sort_values(by="roa", ascending=False)

filter_list = df["stocks"].iloc[:, -1].tolist()

print(filter_list)

return filter_list[:6] (4)动量因子打分

动量因子评分,选择评分最高的5只股票,计算两个值:

年化收益率:250天的年化收益率

高R平方值:用于评估趋势的稳定性,高R平方值意味着价格变动更符合线性趋势,策略信号更可靠,筛选出趋势明显的股票,避免在波动大或无趋势的市场中交易。

def MOM(context, stock, days):

pre_date = context.previous_date.strftime('%Y%m%d')

df = get_price(stock, end_date=pre_date, frequency='1d',

fields=['close'], count=days)

y = np.log(df['close'])

n = len(y)

x = np.arange(n)

weights = np.linspace(1, 2, n)

slope, intercept = np.polyfit(x, y, 1, w=weights)

annualized_returns = math.pow(math.exp(slope), 250) - 1

residuals = y - (slope * x + intercept)

weighted_residuals = weights * residuals**2

r_squared = 1 - (np.sum(weighted_residuals) / np.sum(weights * (y - np.mean(y))**2))

score = annualized_returns * r_squared

return score

def Moment_rank(context, stock_pool, days, ll, hh):

score_list = []

for stock in stock_pool:

score = MOM(context, stock, days)

score_list.append(score)

df = pd.DataFrame(index=stock_pool, data={'score':score_list})

df = df.sort_values(by='score', ascending=False) # 降序

df = df[(df['score']>ll) & (df['score']<hh)]

rank_list = list(df.index)

return rank_list3、调仓逻辑

(1)卖出

卖出不在目标股票池中的股票

hold_list = list(context.portfolio.positions.keys())

for stock in hold_list:

if stock not in buy_stocks[:g.buy_stock_count]:

log.info("调出平仓:[%s]" % (stock))

close_position(stock)

else:

log.info("已持仓,本次不买入:[%s]" % (stock))(2)买入

根据可用资金平均分配买入

# 根据股票数量分仓

# 此处只根据可用金额平均分配购买,不能保证每个仓位平均分配

stocks = updatePositions(context)

position_count = len(stocks)

if g.buy_stock_count > position_count:

value = context.portfolio.cash / (g.buy_stock_count - position_count)

for stock in buy_stocks[:g.buy_stock_count]:

if stock not in stocks:

open_position(stock, value)这篇文章主要分享沪深300指数增强策略,主要的逻辑在市场位置判断以及选股逻辑上,适合资金量大的稳健投资者。

如果有不懂的,欢迎找我一起交流,加入量化交易大家庭

更多推荐

已为社区贡献6条内容

已为社区贡献6条内容

所有评论(0)