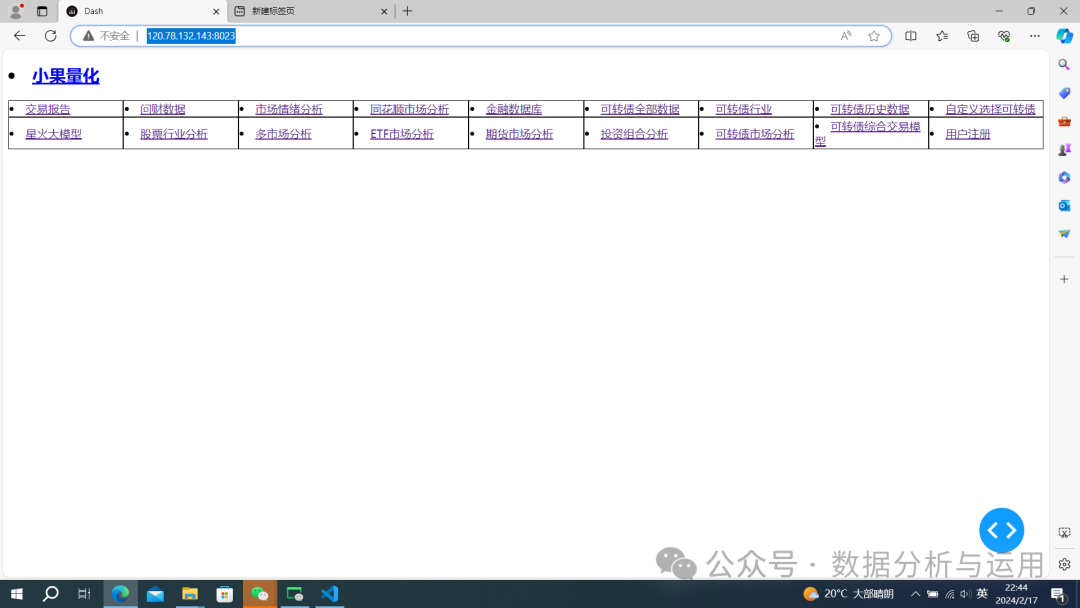

综合交易模型---债券ETF趋势轮动策略回测报告,提供源代码

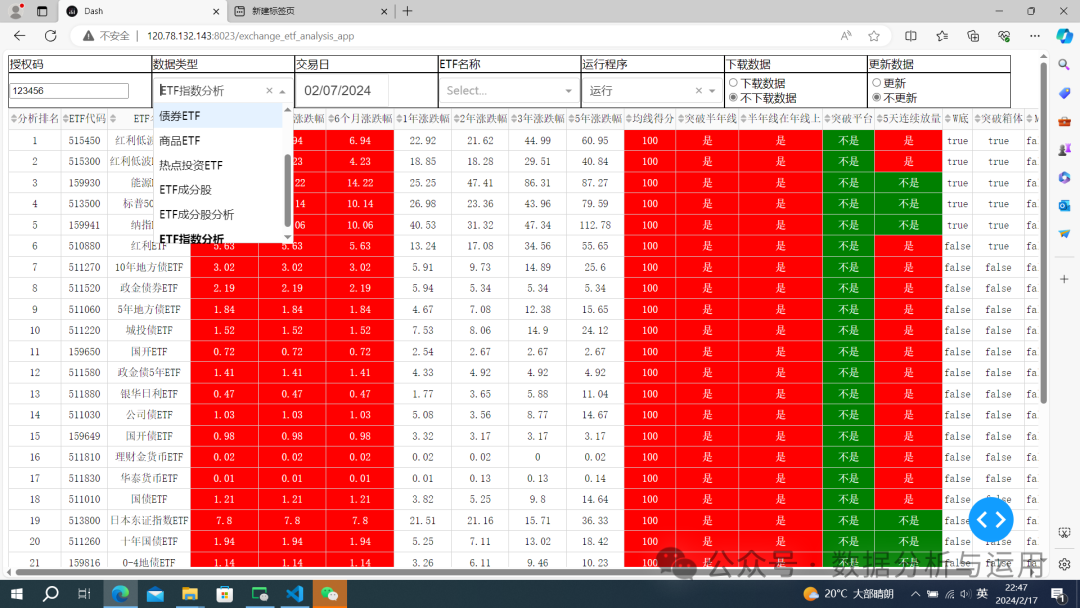

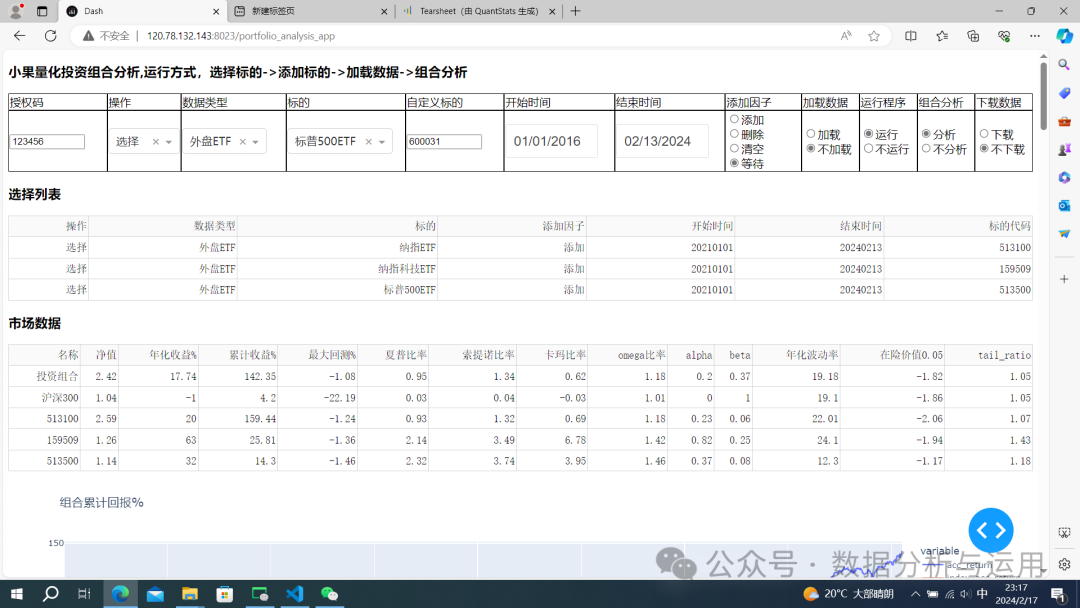

etf分析网页http://120.78.132.143:8023/exchange_etf_analysis_app。etf分析可以看我网页http://120.78.132.143:8023/实盘设置我们利用可转债趋势轮动策略交易市场选择债券就可以。策略收益报告,最近3年,年华3%差不多,基本没有回测。运行user def models更新数据。运行traer_st开头的进入实盘交易。全部源代

·

etf分析可以看我网页http://120.78.132.143:8023/

etf分析网页http://120.78.132.143:8023/exchange_etf_analysis_app

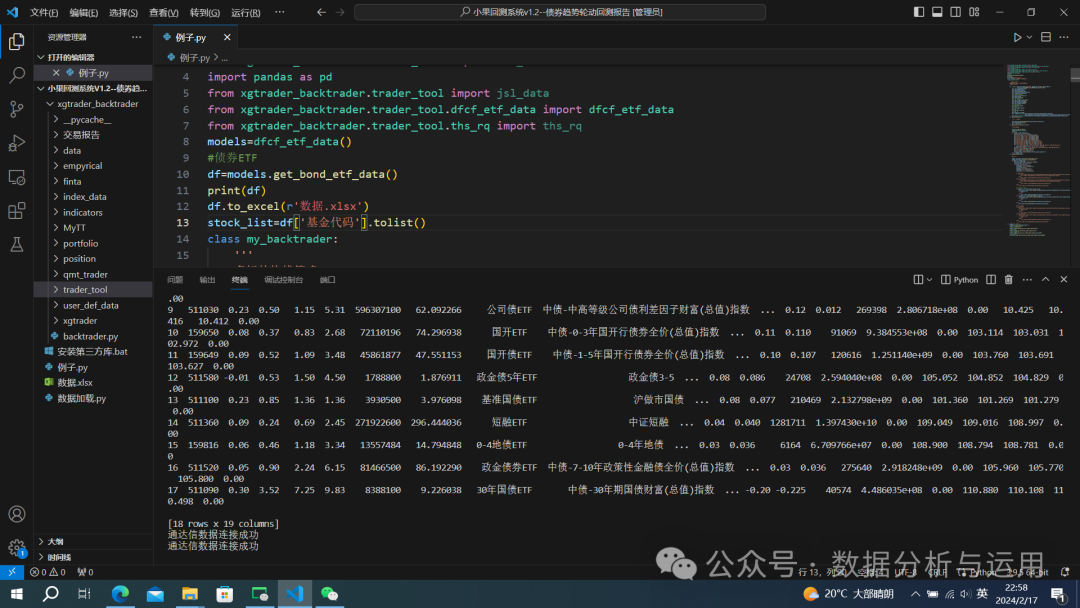

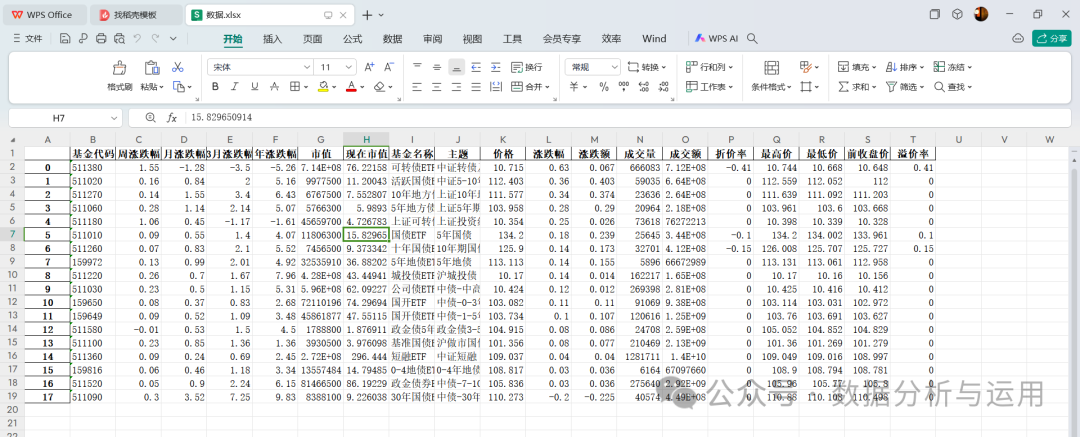

债券ETf

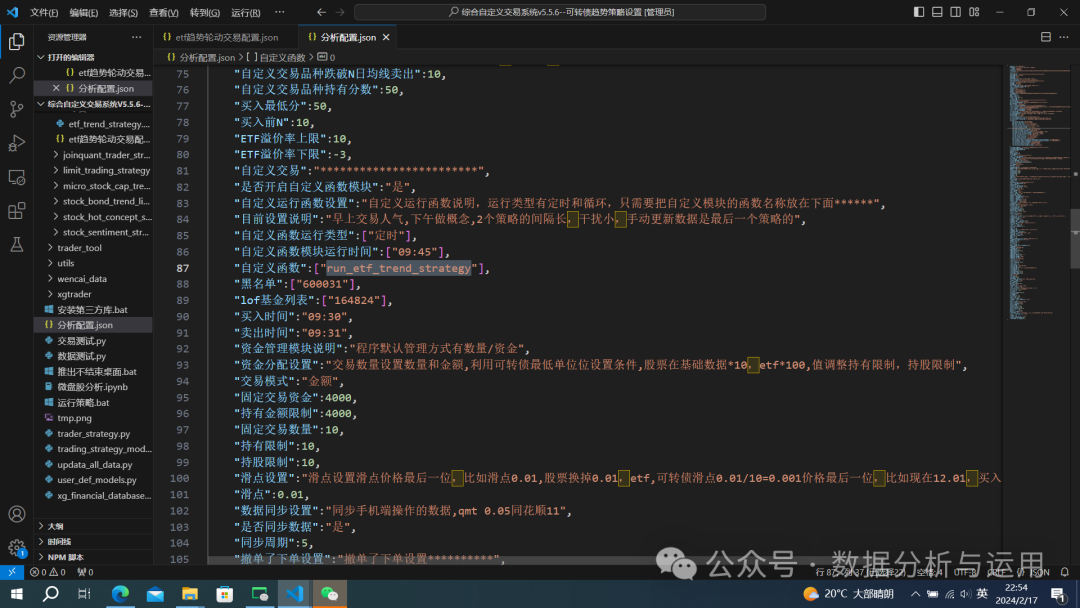

实盘设置我们利用可转债趋势轮动策略交易市场选择债券就可以

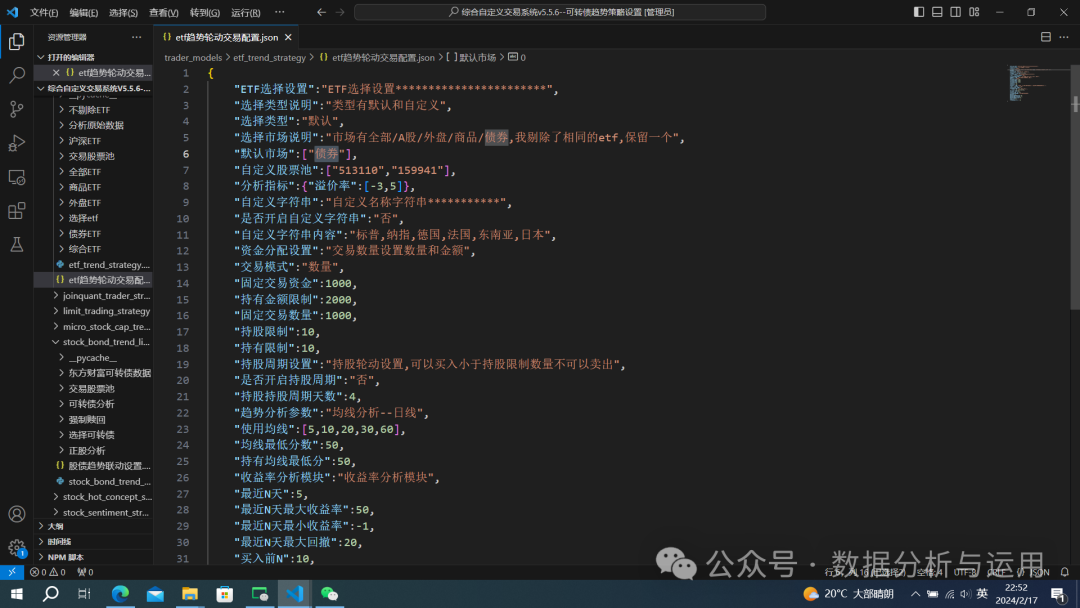

{"ETF选择设置":"ETF选择设置***********************","选择类型说明":"类型有默认和自定义","选择类型":"默认","选择市场说明":"市场有全部/A股/外盘/商品/债券,我剔除了相同的etf,保留一个","默认市场":["债券"],"自定义股票池":["513110","159941"],"分析指标":{"溢价率":[-3,5]},"自定义字符串":"自定义名称字符串***********","是否开启自定义字符串":"否","自定义字符串内容":"标普,纳指,德国,法国,东南亚,日本","资金分配设置":"交易数量设置数量和金额","交易模式":"数量","固定交易资金":1000,"持有金额限制":2000,"固定交易数量":1000,"持股限制":10,"持有限制":10,"持股周期设置":"持股轮动设置,可以买入小于持股限制数量不可以卖出","是否开启持股周期":"否","持股持股周期天数":4,"趋势分析参数":"均线分析--日线","使用均线":[5,10,20,30,60],"均线最低分数":50,"持有均线最低分":50,"收益率分析模块":"收益率分析模块","最近N天":5,"最近N天最大收益率":50,"最近N天最小收益率":-1,"最近N天最大回撤":20,"买入前N":10,"跌破N日均线卖出":10}

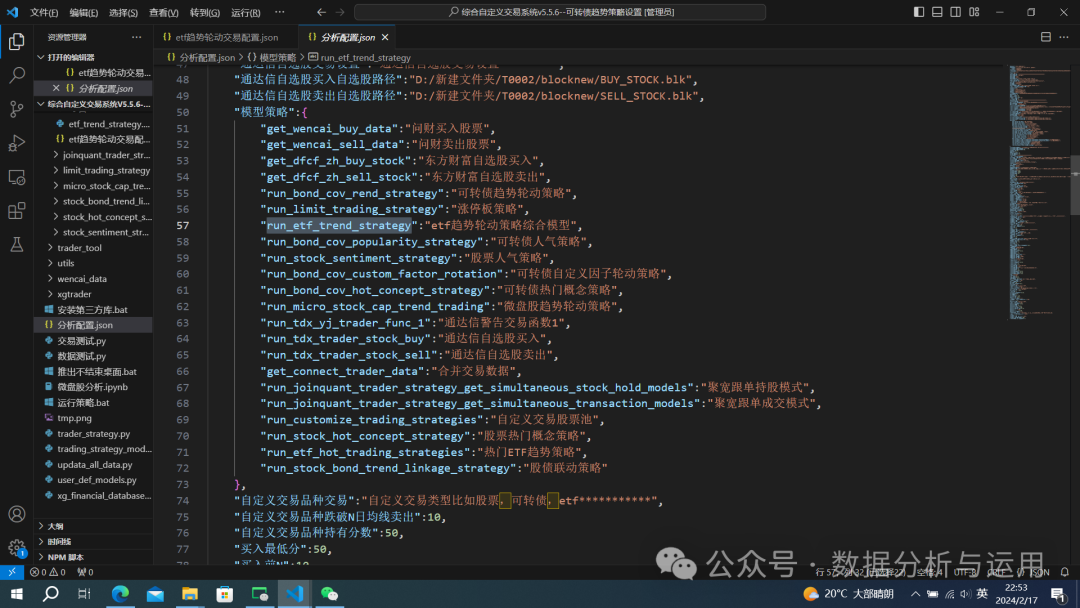

分析配置里面选择etf趋势策略

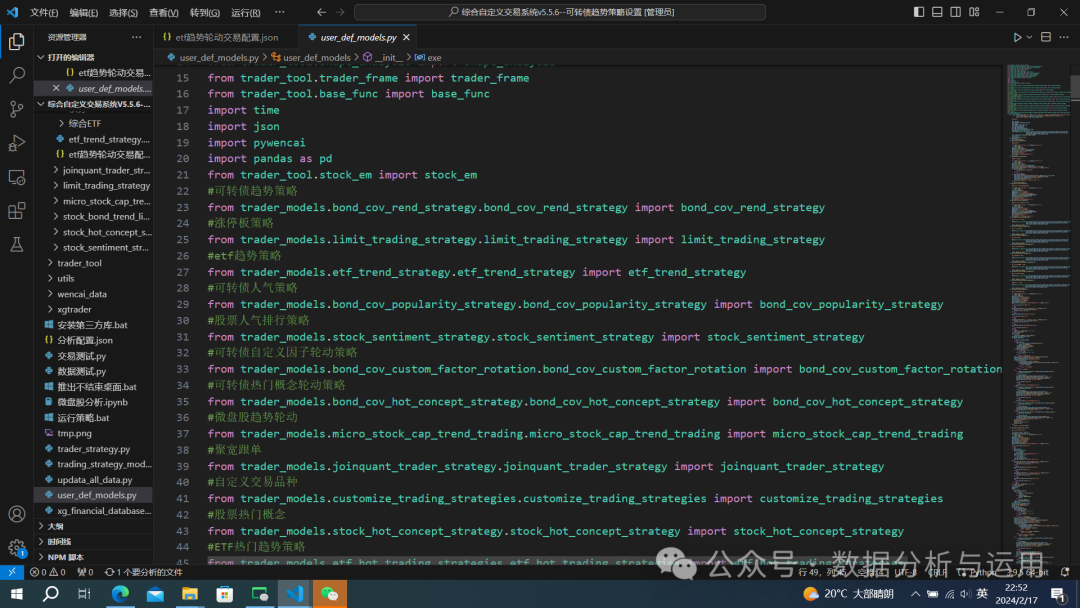

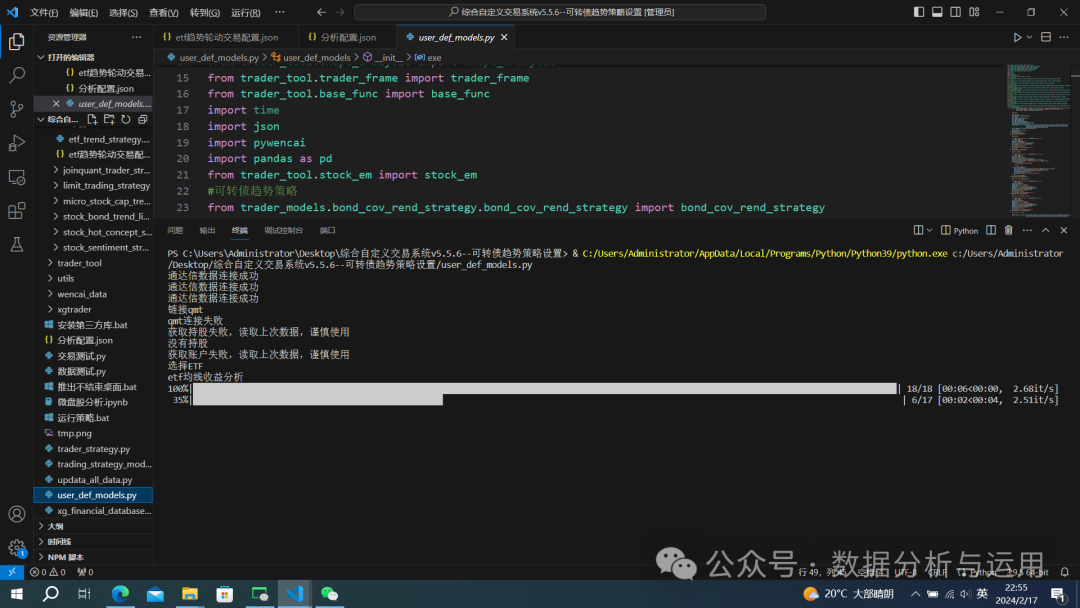

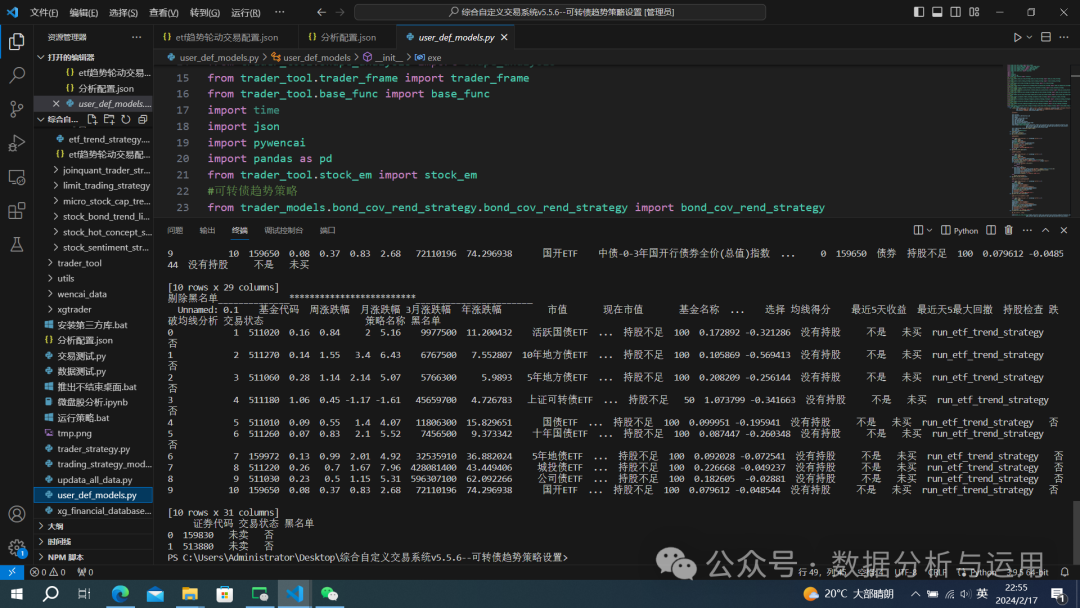

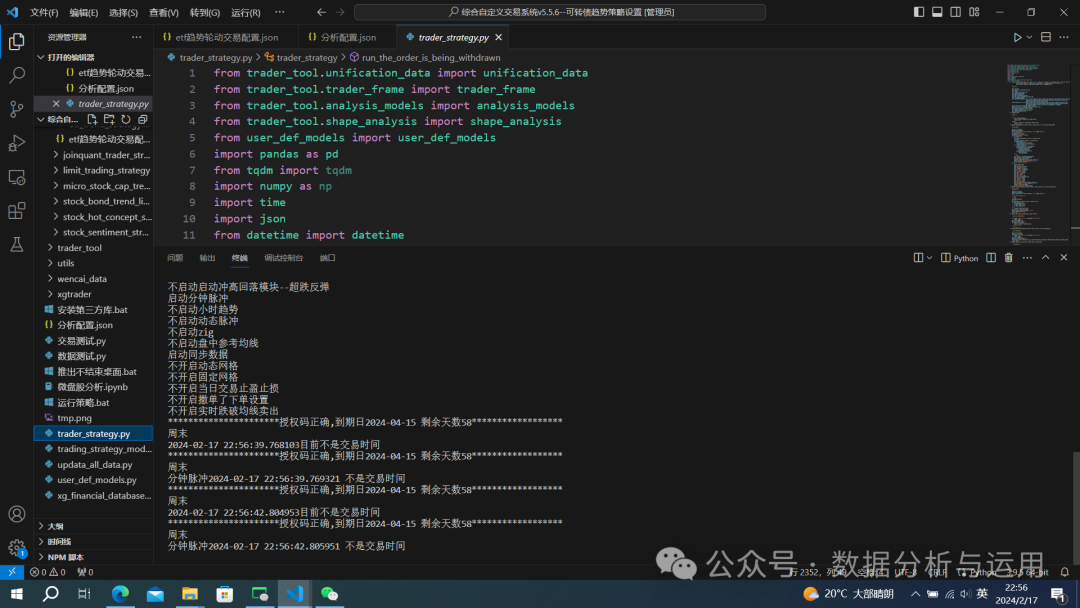

运行user def models更新数据

更新数据

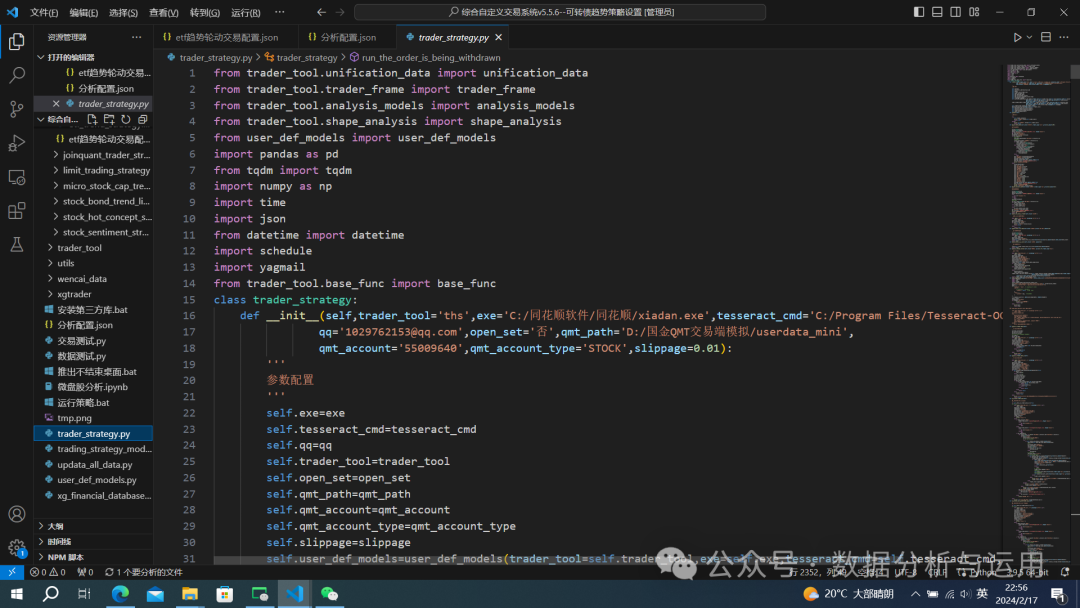

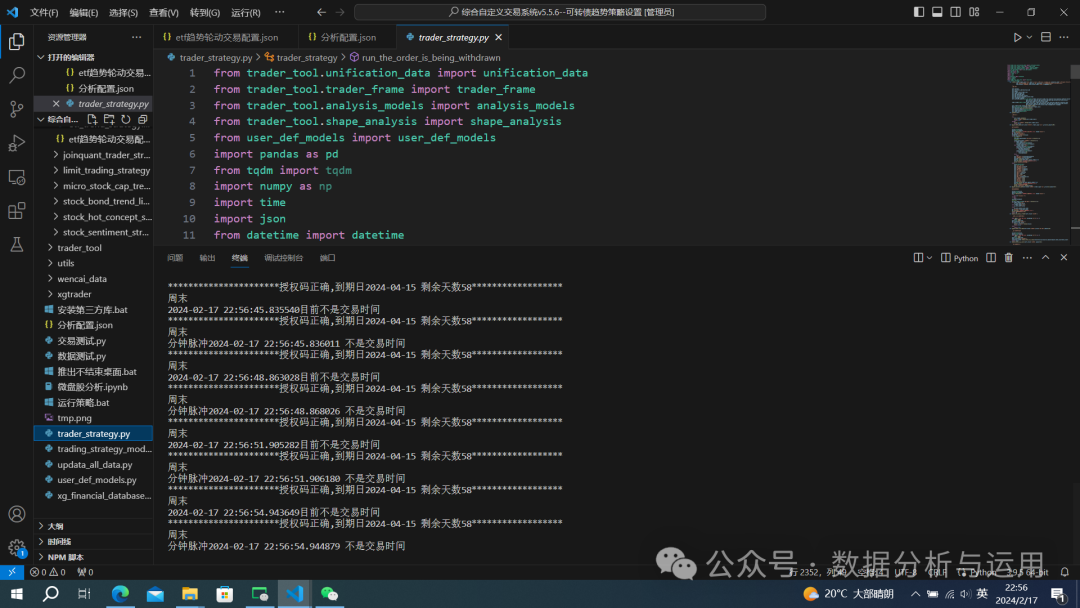

运行traer_st开头的进入实盘交易

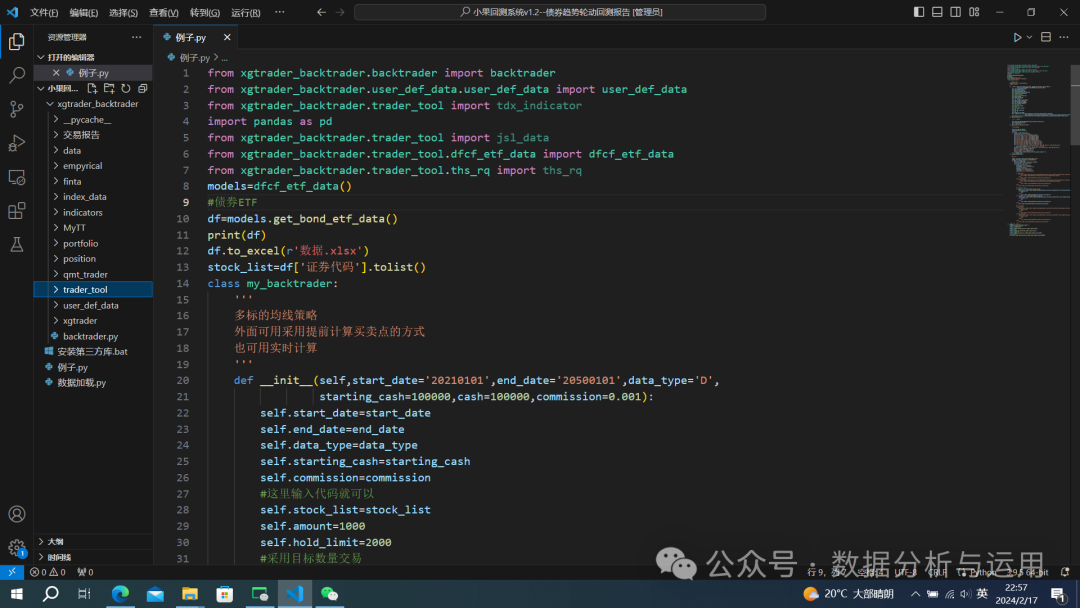

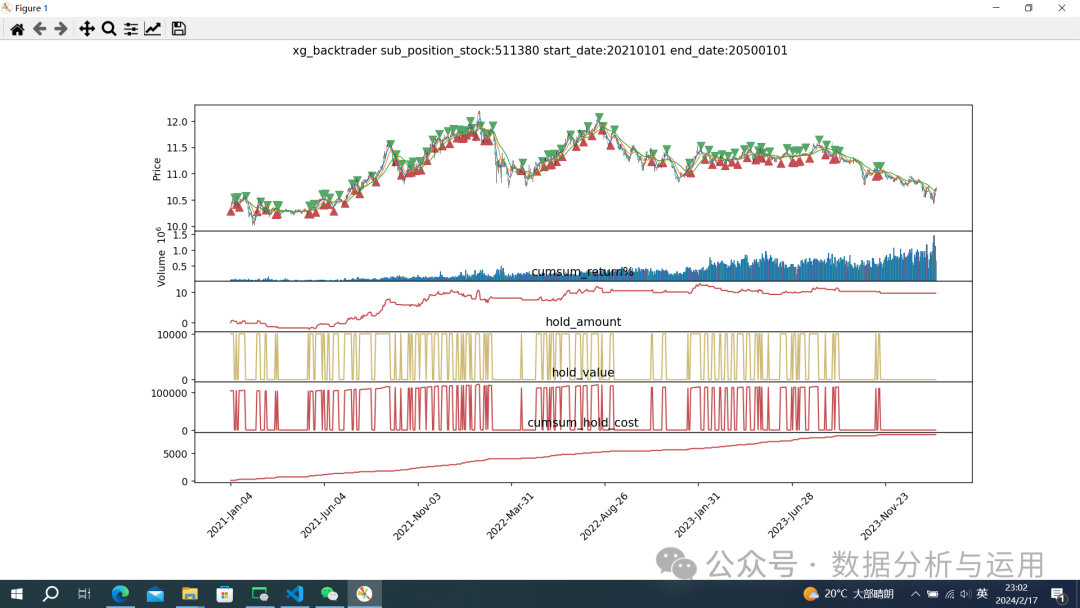

回测,我们直接运行回测框架1.2

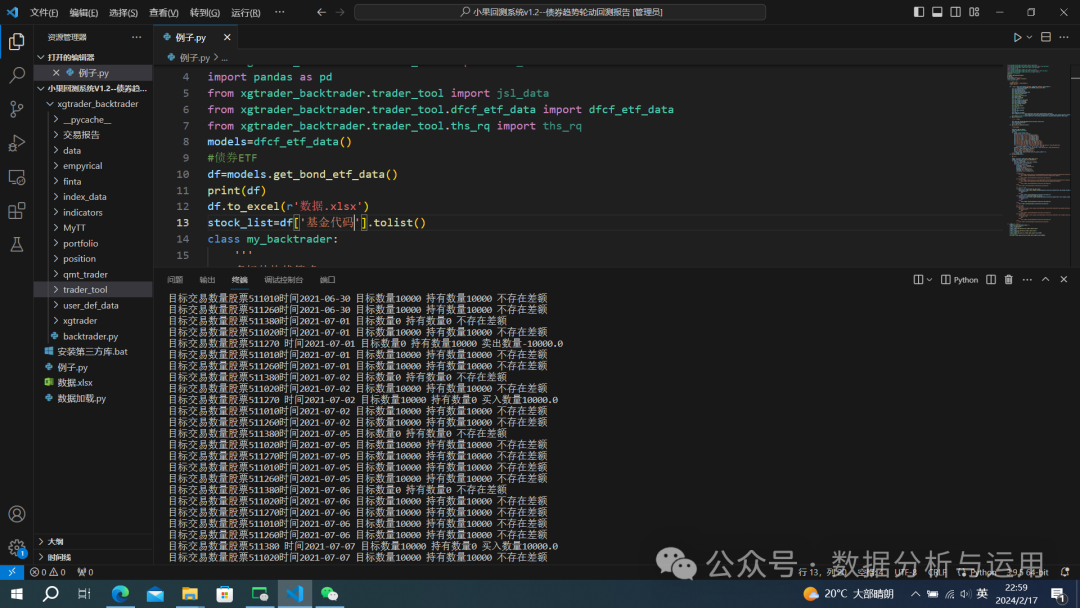

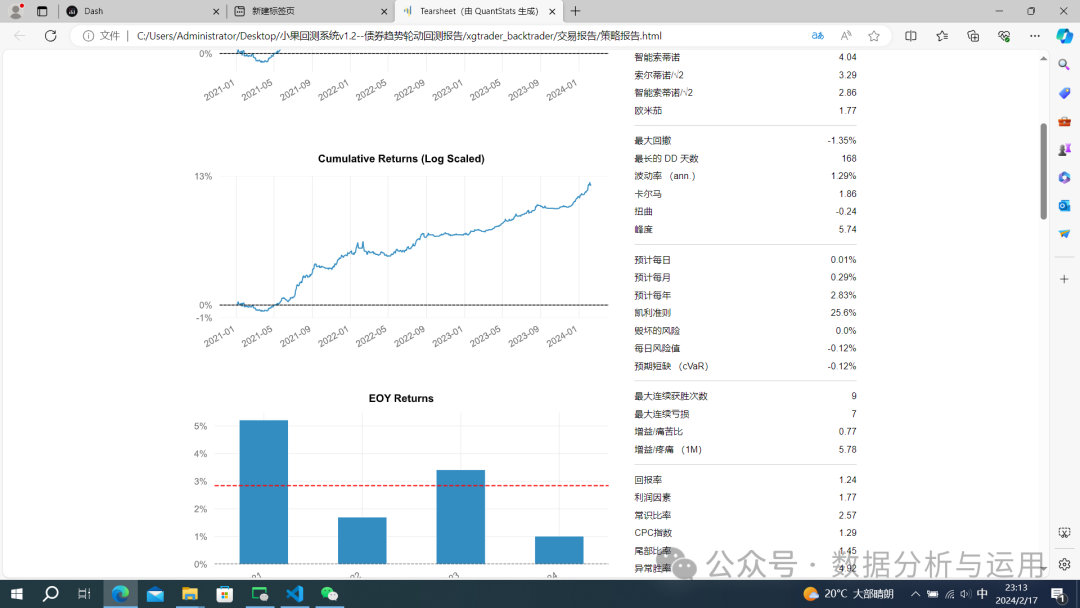

开始回测,最近3年的

数据

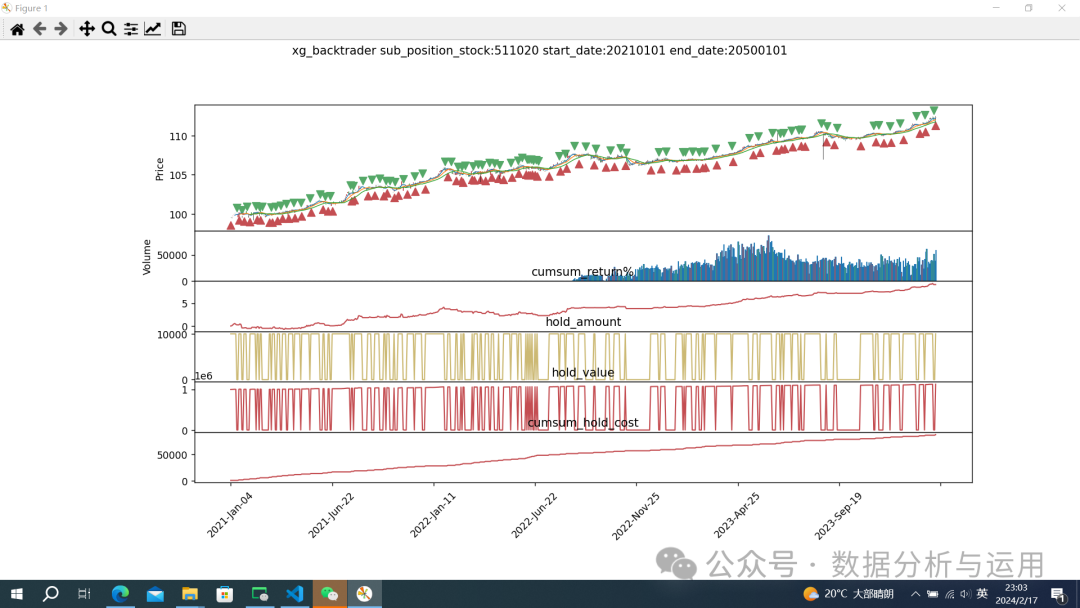

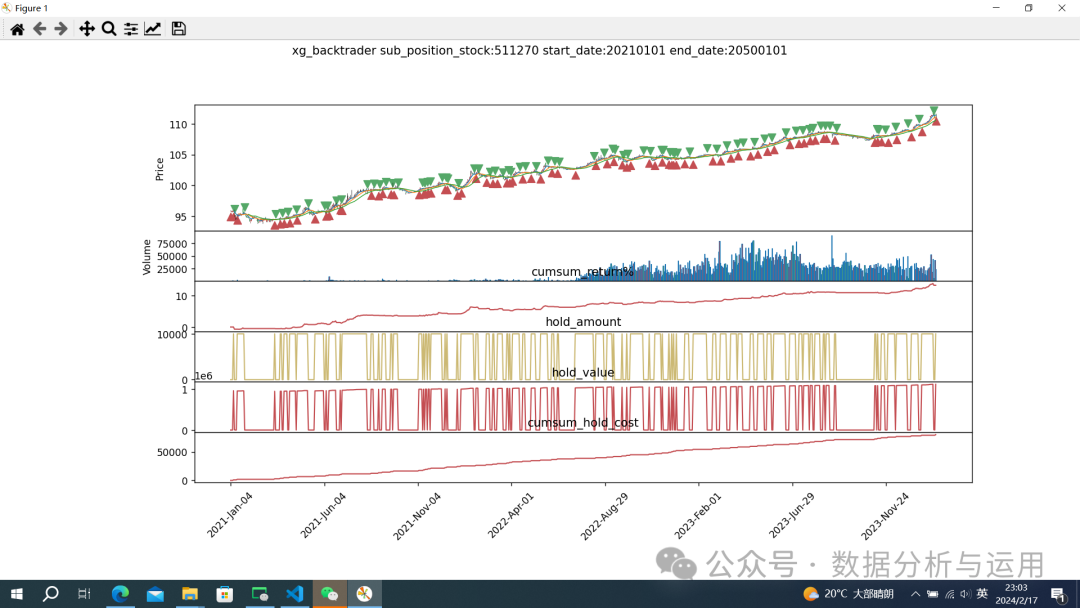

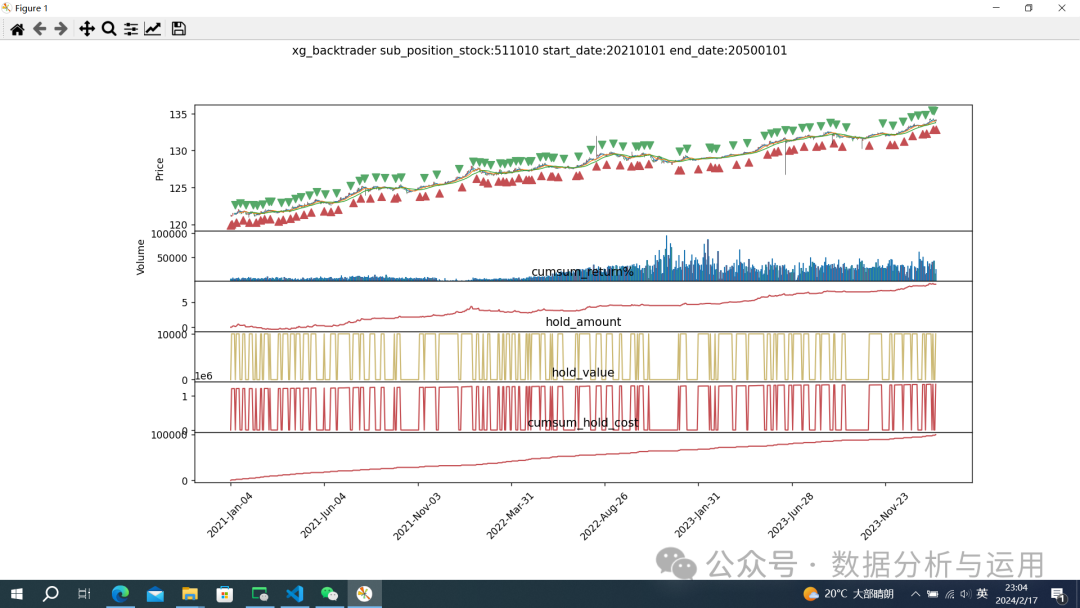

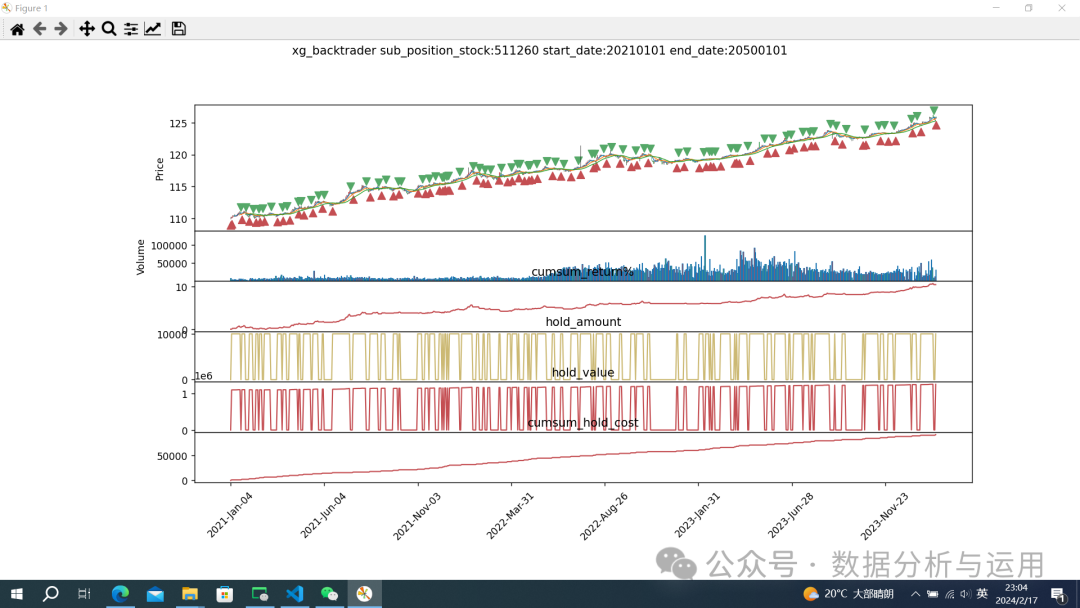

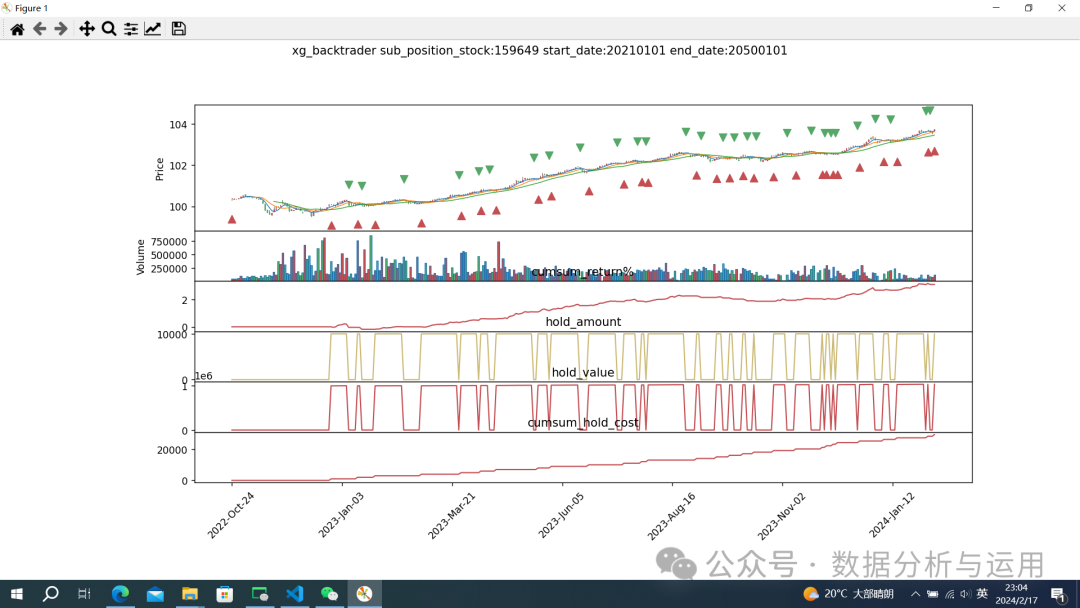

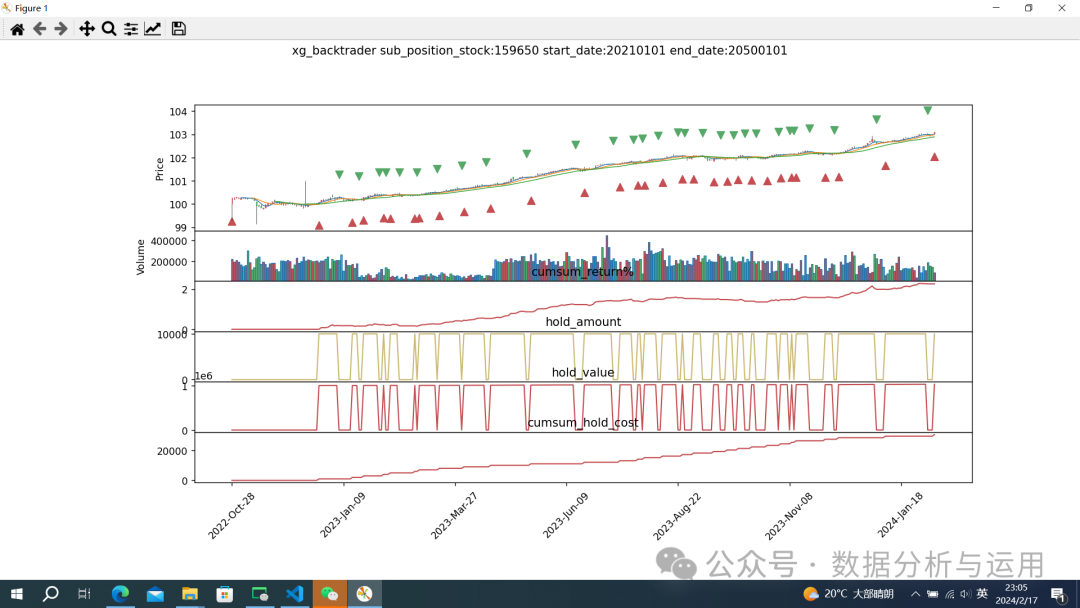

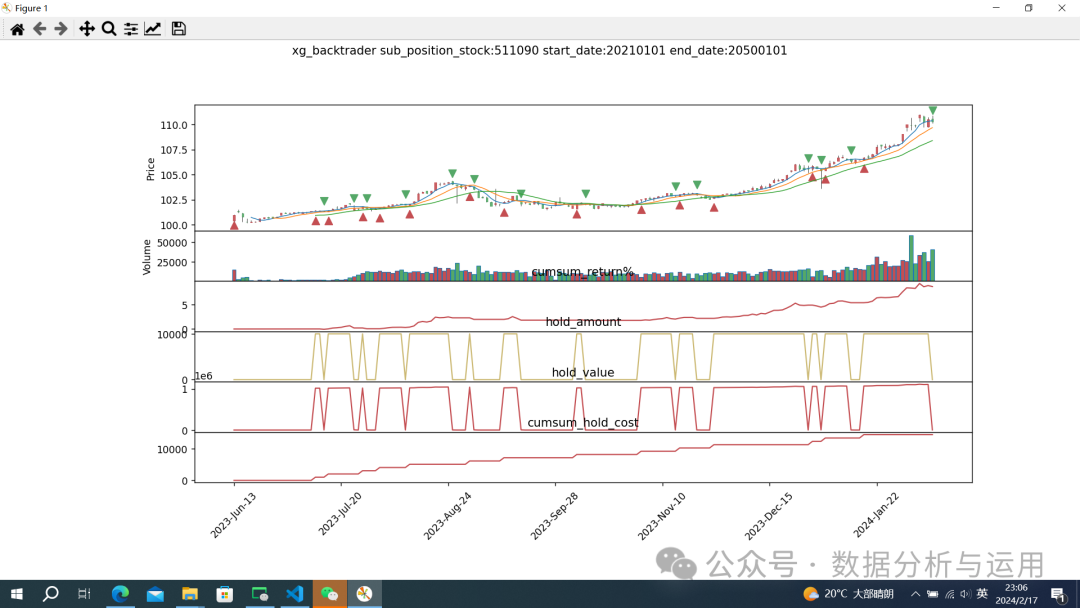

个股交易

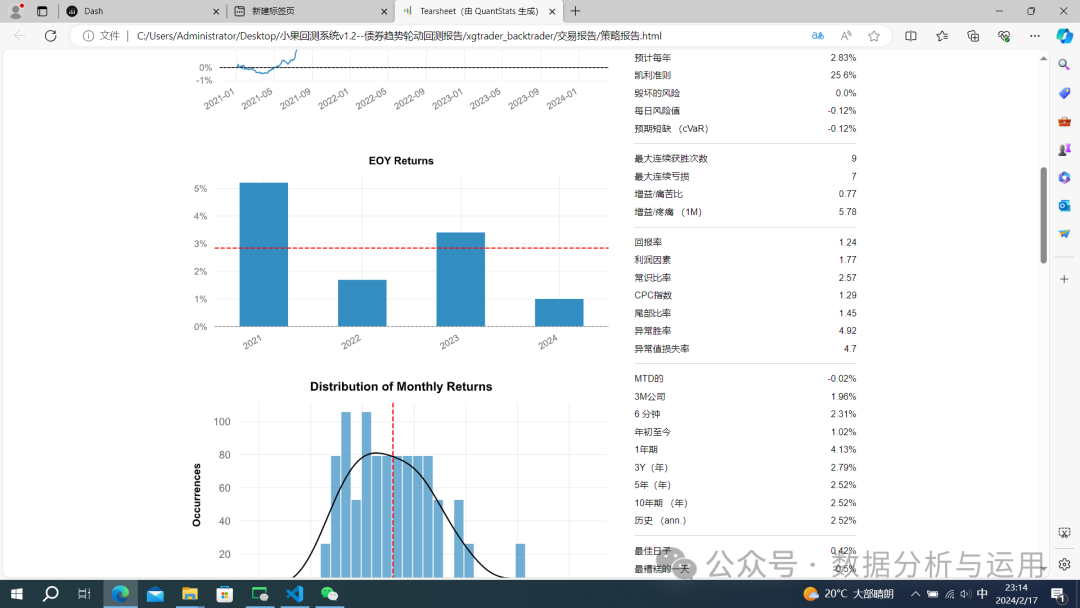

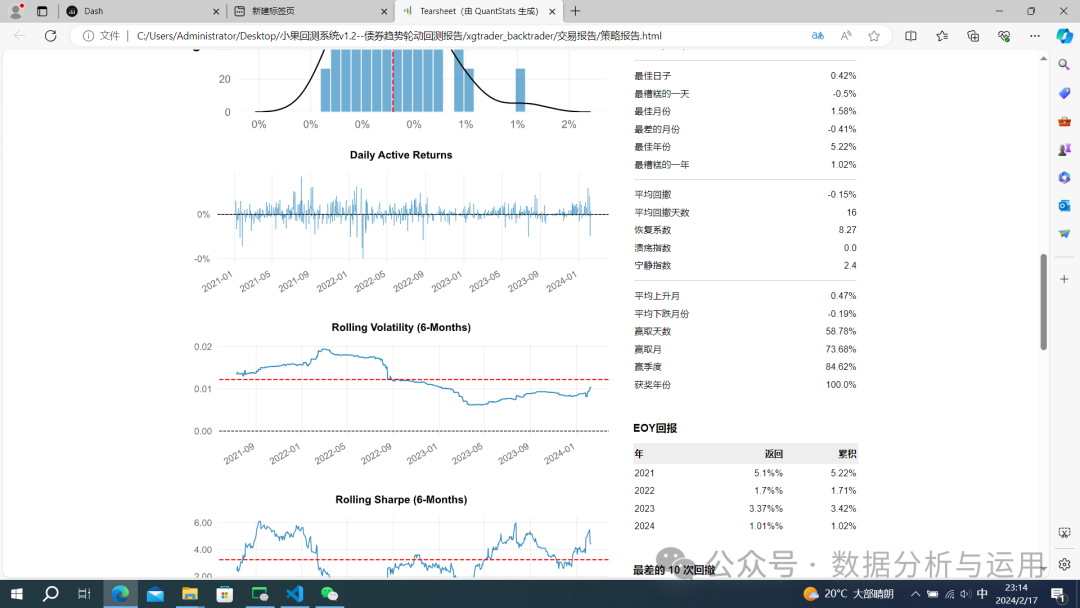

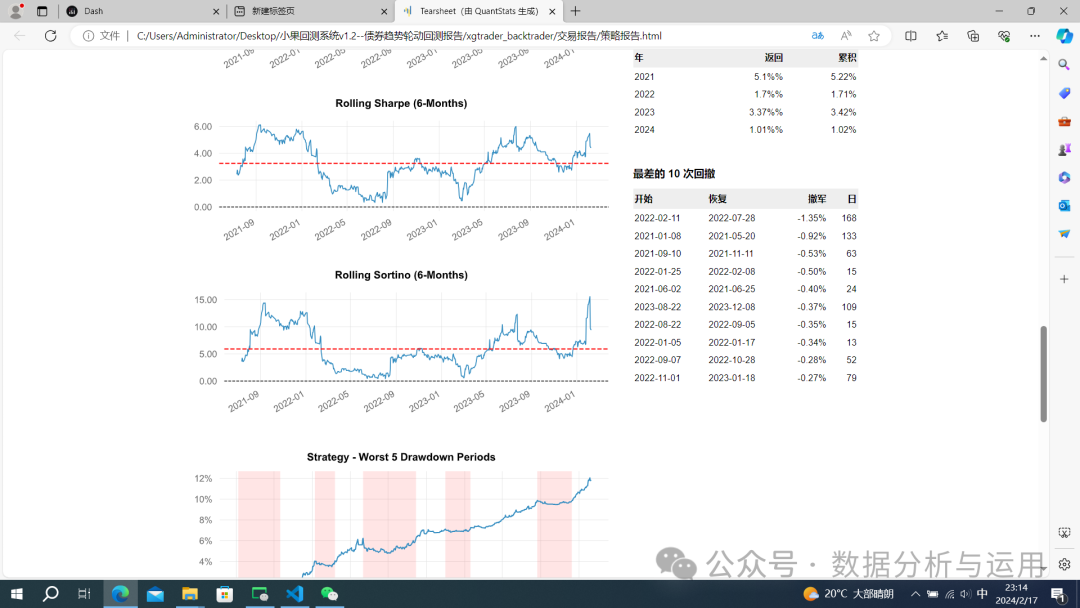

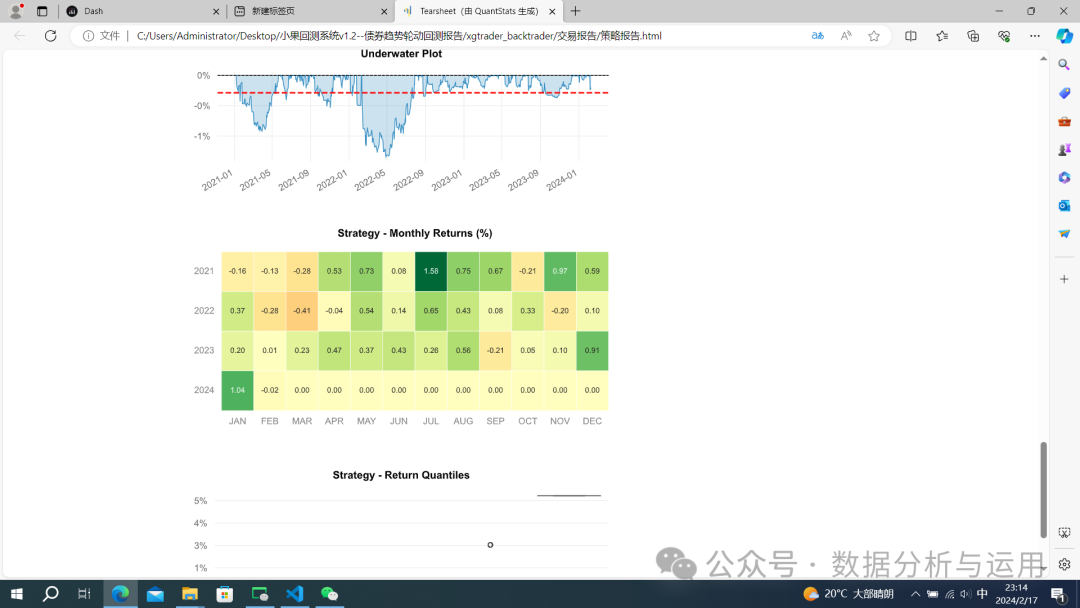

策略收益报告,最近3年,年华3%差不多,基本没有回测

还是纳斯达克厉害,小果投资组合分析网页

http://120.78.132.143:8023/portfolio_analysis_app

全部源代码在知识星球可以直接下载实盘

全部的回测源代码

from xgtrader_backtrader.backtrader import backtraderfrom xgtrader_backtrader.user_def_data.user_def_data import user_def_datafrom xgtrader_backtrader.trader_tool import tdx_indicatorimport pandas as pdfrom xgtrader_backtrader.trader_tool import jsl_datafrom xgtrader_backtrader.trader_tool.dfcf_etf_data import dfcf_etf_datafrom xgtrader_backtrader.trader_tool.ths_rq import ths_rqmodels=dfcf_etf_data()#债券ETFdf=models.get_bond_etf_data()print(df)df.to_excel(r'数据.xlsx')stock_list=df['基金代码'].tolist()class my_backtrader:'''多标的均线策略外面可用采用提前计算买卖点的方式也可用实时计算'''def __init__(self,start_date='20210101',end_date='20500101',data_type='D',starting_cash=100000,cash=100000,commission=0.001):self.start_date=start_dateself.end_date=end_dateself.data_type=data_typeself.starting_cash=starting_cashself.commission=commission#这里输入代码就可以self.stock_list=stock_listself.amount=1000self.hold_limit=2000#采用目标数量交易self.buy_target_volume=10000self.sell_target_volume=0self.buy_target_value=5000self.sell_target_value=0#上涨突破5日线买self.buy_mean_line=5#下跌10日线卖self.sell_mean_line=10#买的最低分self.buy_min_score=50#持有最低分self.hold_min_score=50self.trader=backtrader(start_date=self.start_date,end_date=self.end_date,data_type=self.data_type,starting_cash=self.starting_cash,commission=self.commission,cash=cash)self.data=user_def_data(start_date=self.start_date,end_date=self.end_date,data_type=self.data_type)def add_all_data(self):'''多线程加载数据'''self.data.get_thread_add_data(stock_list=self.stock_list)self.hist=self.data.histreturn self.histdef get_cacal_all_indicators(self):'''计算全部的指标'''hist=self.add_all_data()trader_info=pd.DataFrame()#拆分数据for stock in self.stock_list:df=hist[hist['stock']==stock]df['mean_5']=df['close'].rolling(5).mean()df['mean_10']=df['close'].rolling(10).mean()df['mean_20']=df['close'].rolling(20).mean()df['mean_30']=df['close'].rolling(30).mean()df['mean_60']=df['close'].rolling(60).mean()df['mean_5_mean_10']=df['mean_5']>=df['mean_10']df['mean_10_mean_20']=df['mean_10']>=df['mean_20']df['mean_20_mean_30']=df['mean_20']>=df['mean_30']df['mean_30_mean_60']=df['mean_30']>=df['mean_60']for i in ['mean_5_mean_10','mean_10_mean_20','mean_20_mean_30','mean_30_mean_60']:df[i]=df[i].apply(lambda x: 25 if x==True else 0)df1=df[['mean_5_mean_10','mean_10_mean_20','mean_20_mean_30','mean_30_mean_60']]df['score']=df1.sum(axis=1).tolist()df['buy']=df['close']>df['mean_5']df['sell']=df['close']<df['mean_5']trader_info=pd.concat([trader_info,df],ignore_index=True)return trader_infodef run_backtrader(self):'''运行回测'''trader_list=self.trader.get_trader_date_list()trader_info=self.get_cacal_all_indicators()for date in trader_list:df=trader_info[trader_info['date']==date]stock_list=df['stock'].tolist()for stock in stock_list:df1=df[df['stock']==stock]price=df1['close'].tolist()[-1]price=float(price)buy=df1['buy'].tolist()[-1]sell=df1['sell'].tolist()[-1]score=df1['score'].tolist()[-1]'''if buy==True:if self.trader.check_stock_is_av_buy(date=date,stock=stock,price=price,amount=self.amount,hold_limit=self.hold_limit):self.trader.buy(date=date,stock=stock,price=price,amount=self.amount)else:self.trader.settle(date=date,stock=stock,price=price)elif sell==True:if self.trader.check_stock_is_av_sell(date=date,stock=stock,price=price,amount=self.amount):self.trader.sell(date=date,stock=stock,price=price,amount=self.amount)else:self.trader.settle(date=date,stock=stock,price=price)else:self.trader.settle(date=date,stock=stock,price=price)'''#目标数量回测例子if buy==True and score>=self.buy_min_score:result=self.trader.order_target_volume(date=date,stock=stock,amount=self.buy_target_volume,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)elif sell==True or score<=self.hold_min_score:result=self.trader.order_target_volume(date=date,stock=stock,amount=self.sell_target_volume,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)else:self.trader.settle(date=date,stock=stock,price=price)'''#目标价值交易if buy==True:result=self.trader.order_target_value(date=date,stock=stock,value=self.buy_target_value,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)elif sell==True:result=self.trader.order_target_value(date=date,stock=stock,value=self.sell_target_value,price=price)if result==True:passelse:self.trader.settle(date=date,stock=stock,price=price)else:self.trader.settle(date=date,stock=stock,price=price)'''if __name__=='__main__':trader=my_backtrader(data_type='D')trader.run_backtrader()#获取全部的交易报告trader.trader.get_poition_all_trader_report_html()#获取策略报告trader.trader.get_portfolio_trader_report_html()#显示个股的交易图trader.trader.get_plot_all_trader_data_figure(limit=1000)#显示策略数据df=trader.trader.get_portfolio_trader_data_figure(limit=100000

更多推荐

已为社区贡献24条内容

已为社区贡献24条内容

所有评论(0)